Table Of Content

Whether you should buy a house now or wait ultimately depends on your finances and market conditions. While you might consider current mortgage rates ideal, you might benefit from waiting to build credit or saving for a bigger down payment. Speak with a lender or real estate agent before making the decision to buy this year or wait. The down payment is often considered the biggest homebuying expense, since it’s a large amount that the buyer has to actually pay upfront. But homeownership involves plenty of additional costs that you should be ready for.

Housing Market Predictions For 2024: When Will Home Prices Be Affordable Again? - Forbes

Housing Market Predictions For 2024: When Will Home Prices Be Affordable Again?.

Posted: Thu, 25 Apr 2024 16:49:00 GMT [source]

Wild ending to baseball’s regular season, now it’s time for CIF-SS playoffs

In 2021, they used a combination of their personal savings and a first-time home buyer loan to buy their first property together — a multifamily building that they fixed up and rent out. He previously worked as a reporter for the Omaha World-Herald, Newsday and the Florida Times-Union. His reporting primarily focuses on the U.S. housing market, the business of sports and bankruptcy.

Rocket Mortgage

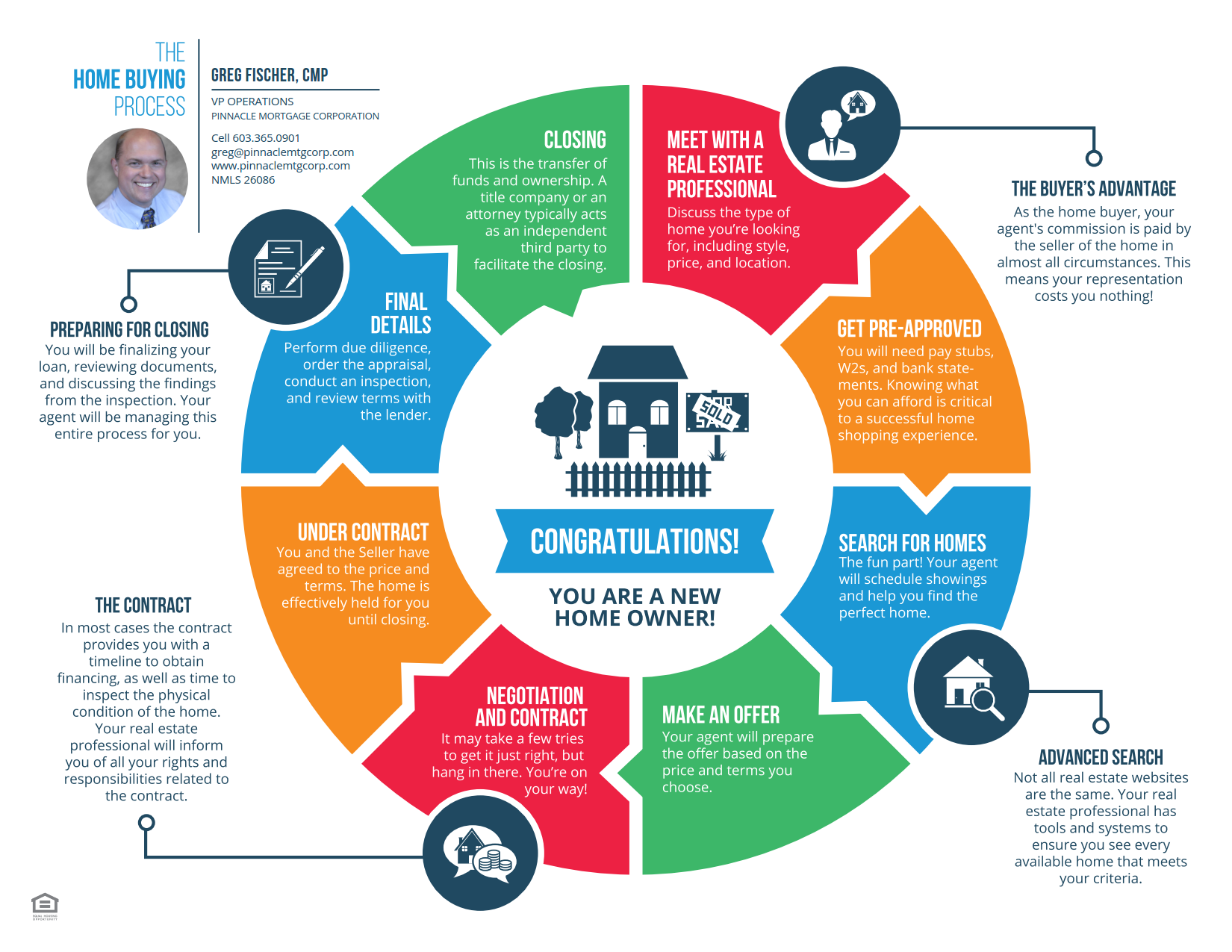

Let’s take a closer look at what each step involves and what you’ll do along the way. It’s critical to know what to look for when buying a house so you enter the process with clarity and purpose. Having criteria for your dream home and neighborhood could mean the difference between finding the right fit—or making a mistake. A final walk-through is your opportunity to view the property one last time before it becomes yours. This is your last chance to address any outstanding issues before the house becomes your responsibility.

Step 3: Save For A Down Payment And Closing Costs

Debt-to-income ratio (DTI) is another factor mortgage lenders assess when considering your loan application. Your DTI helps your lender see how much of your monthly income goes to debt payments so they can evaluate the amount of mortgage debt you can take on. As you’re getting ready to make an offer on a home, it’s important to understand that there is a decent chance that another buyer might not need to submit any kind of pre-approval documentation. Redfin data shows that 16 percent of purchases in the LA metro area were all-cash deals in the first quarter of 2021. Additionally, it’s important to note that a statewide shift away from a seller’s market is already happening.

But in general, a lower score means you might find it harder to get approved for a mortgage, and you likely won't have access to the best rates. The specific closing costs will depend on your loan type, your lender and where you live. Most homeowners will pay for items like appraisal fees and title insurance. If you take out a government-backed loan, you’ll typically need to pay an insurance premium or funding fee upfront. The specific amount you’ll pay in closing costs will depend on where you live and your loan type.

Step 10: Get A Home Appraisal

The first step in researching how to buy a house is to check your credit report. Your credit score is important as it influences whether you qualify for a loan, the type of loan, and what interest rate you’ll receive. You might be wondering, what credit score is needed to buy a house? It is important to keep in mind that the lower your credit score, the higher your interest rate is likely to be.

With a higher credit score, you’ll likely qualify for a lower interest rate. If you find that your credit score is lower than you anticipated, you can research how to increase your credit score quickly so you can start house shopping. When you’re ready to start house hunting or if you’ve found a home you want to buy, it’s time to get preapproved for a mortgage.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. Most offers also contain an earnest money deposit, typically 1% – 3% of the purchase price, which shows the seller you’re serious about purchasing. Your earnest money deposit goes toward your down payment and closing costs if you buy the home. If you agree to the home sale and later cancel, you’ll typically lose your deposit.

Since tax rates vary based on location, make sure you ask sellers for a breakdown of their past property tax bills to get a sense of how you’ll pay. It's important to point out that your credit score isn't the only factor that lenders consider during the underwriting process. Even with a strong score, a lack of income or employment history or a high debt-to-income ratio could cause your mortgage approval to fall through. It's important to point out lenders are free to set higher minimum credit score requirements than what the loan-backing organizations require. Some lenders may require a minimum score of 660 for conventional loans, or a score of 580 for a VA loan, for example. Your real estate agent will help you hunt for houses within your budget.

The next step when buying a house is to start browsing homes for sale in your area. That way, you’ll be able to narrow down your search to the specific price range, style of home, location and neighborhood, and other amenities when searching for homes on the MLS. Los Angeles is not the priciest part of California, but it’s still plenty pricey. The median sales price of a single-family home in the Los Angeles metro area hit $750,000 in September (roughly double the national median), according to data from the California Association of Realtors.

Read over your inspection results with your agent and ask whether they noticed any major red flags. Begin by asking family members and friends for recommendations to find a good real estate agent. Direct referrals are often the best way to get unbiased information on agents in your area. Many states offer down payment assistance programs to qualified buyers, so research whether any assistance is available to make your home purchase more affordable. The amount you’ll need for a down payment depends on your loan type and how much you borrow. If a down payment is required, you can buy a home with as little as 3% down (although putting down more has benefits).

Ultimately, the right time to buy a home depends on your unique situation. With so many considerations to weigh in potential properties, here are some red flags to look out for when buying a house, especially during the viewing. Find out how property taxes are calculated and which exemptions you might qualify for to reduce your tax bill. Bankrate has partnerships with issuers including, but not limited to, American Express, Bank of America, Capital One, Chase, Citi and Discover.

Don’t open new credit lines or make any major purchases until the paperwork is signed, and avoid changing jobs before closing too, if possible. While LA is the opposite of “bargain,” there are pockets where you can find a cheaper place to call home. Redfin’s data shows that living in downtown Los Angeles comes with a lower price tag – $625,000 as of September – and there are other cost-effective suburbs to consider, such as Baldwin Park and Montebello. Of course, if money isn’t an issue for you, you can get closer to the water by exploring Marina del Rey, Brentwood, Venice, Santa Monica and other high-priced spots within a quick jog of the Pacific Ocean. Beaches, mountains, cosmopolitan energy, cultural institutions and a thriving food scene, all dusted with Hollywood-style sophistication and glam – there are so many reasons to love living in Los Angeles.

No comments:

Post a Comment